What is a Virtual CFO? [Infographic]

“Virtual CFO” certainly sounds like a buzzword of the moment, but it’s a service that could be very beneficial in the long run for your startup or small business. Continue reading to find out what a Virtual CFO is, the benefits of outsourcing to a Virtual CFO, and the positive impact one can have on your growing business.

Virtual CFO: Defined

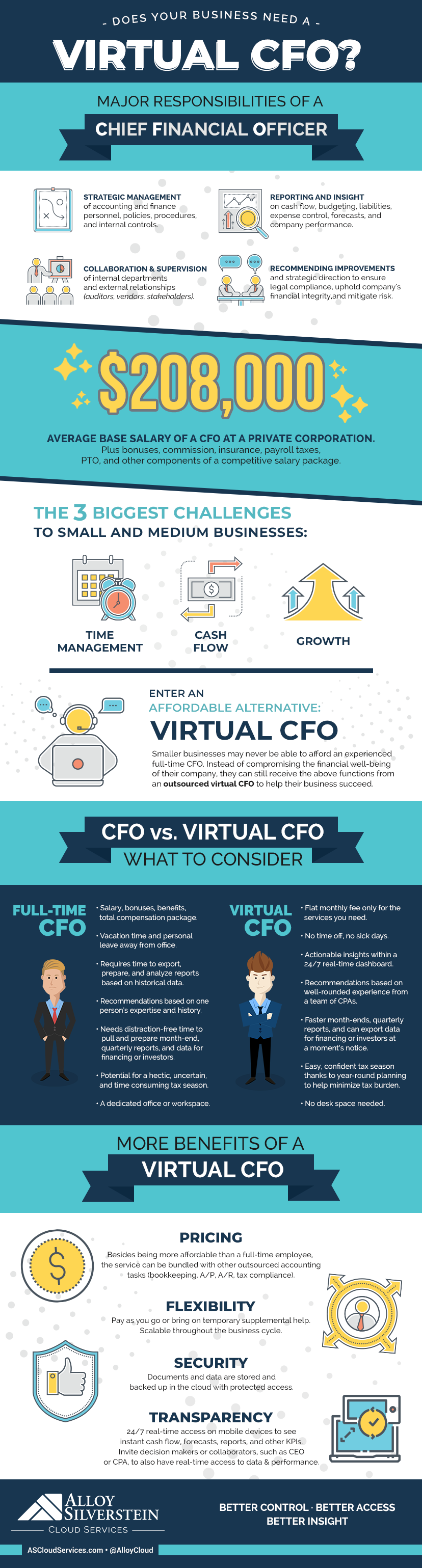

A Chief Financial Officer (CFO) is a key executive at most large corporations. The CFO’s role can consist of reporting on financial performance to other executives, performing month-ends, managing the internal accounting and finance departments, serving as liaison to external vendors, lenders, and investors, ensuring tax and legal compliance, and/or providing strategic direction and recommendations based on the company’s financial data. Per Robert Half, the average salary for a private CFO at a mid-sized company in 2017 was $208,000.

On the other hand, a Virtual CFO (vCFO) is an affordable alternative to hiring a full-time, qualified CFO. It is an outsourced service line offered by cloud accounting and advisory firms so that, even when it’s not feasible to have a CFO, all of the aforementioned CFO duties are still being covered by a competent team of financial and accounting experts. The cost of a Virtual CFO varies from firm to firm and depends on the bundled package, but is a set monthly fee that can range anywhere from $500 to $1,000 to well over $2,000, depending on your business’s monthly needs and the complexity of your systems and transactions.

Being virtual, a vCFO ensures your data and documents are securely stored and accessed via a cloud server in order to promote collaboration across all key accounting and finance personnel.

Does my Business Need a vCFO?

A growing company or startup is still establishing a payroll budget and is often careful about increasing overhead by strategically bringing on valuable team members at the right time. Being realistic, the CFO is not a position that is typically filled in the early-on days of a startup. Instead the duties may be haphazardly split among the president/owner, internal or external advisors, a CPA, internal accountants or bookkeepers, and so on.

The problem then becomes, as your business grows, the decisions you are making today affect the foundation and future of your business. If those decisions are not based on accurate, real-time data and reliable insights and reports, your business’s financial position may not be so clear. In addition affecting business decisions, having accurate, complete, and quick reports is also beneficial if your business is seeking funding, applying for financing, or presenting to venture capitalists and potential investors.

Small and growing businesses often face these three obstacles to success: time management, cash flow, and growth. If these are three of your top concerns as well, it’s time to see if a Virtual CFO can help you get on the right track so your business not only succeeds – it thrives.

Virtual CFO Infographic

Alloy-Virtual CFO Infographic-2018

Alloy-Virtual CFO Infographic-2018

A vCFO is not a fit for every business, especially as your needs and demands grow as you advance through the business cycle. But for businesses looking to be on the cutting-edge of technology and as informed and accurate as possible when it comes to their business finances and accounting tasks, a vCFO could be the way to go.

If you want to talk to an Alloy Silverstein Cloud Coach even further about the benefits of bringing on board a Virtual CFO, contact us today for a consultation.

Alloy Silverstein Cloud Services

Bringing simple online accounting to startups and forward-thinking businesses. Contact us to get started. →